Scaling payment infrastructure isn’t just important; it’s the difference between capturing growth and watching revenue slip away.

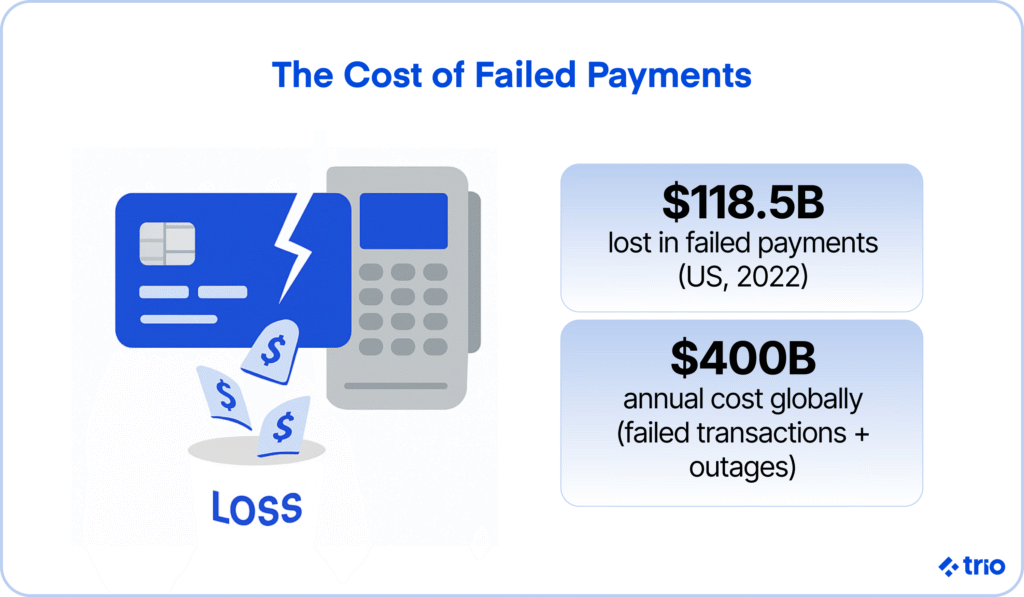

Businesses are processing millions of transactions across multiple geographies and currencies. When systems fail, the cost is steep. In 2022 alone, failed payments cost the United States an incredible $118.5 billion in lost revenue and customer churn.

The problem is that legacy infrastructure wasn’t built for this pace.

In our time in the industry, we’ve seen downtime, rigid integrations, and compliance risks frustrate customers and strangle growth.

Every payment failure not only slows cash flow but also erodes trust, damages your brand, and creates openings for competitors who can offer smoother experiences.

The solution is straightforward: modern, cloud-native, and orchestrated payment infrastructure.

By adopting multi-processor strategies, high-availability patterns, and global-ready architectures, you can achieve reliability, scalability, and compliance at the same time.

At Trio, we connect companies with the people to make this possible. Our fintech specialists can help you build scalable systems, integrate the latest fintech tools, and ensure payments don’t become a bottleneck to growth.

Modernizing payment infrastructure is no longer optional; it’s essential.

Let’s look at how you can adopt orchestration, strengthen compliance, and follow a phased roadmap that positions your business for global expansion and long-term resilience.

Risks of Standing Still

Scaling payments is about avoiding the very real risks of standing still.

Legacy infrastructure wasn’t designed to handle today’s transaction volumes, meet regulatory standards, or adapt to the evolving fraud landscape. And the cracks show quickly.

Downtime isn’t just inconvenient; it’s expensive. Research shows that failed transactions and outages cost businesses over $400 billion each year. That doesn’t even include the reputational hit when customers can’t complete a purchase.

Security is another concern.

Without modern defenses like fraud detection, tokenization, and updated compliance measures such as 3DS v2.2, you could be exposing yourself to fines, chargebacks, and higher fraud losses.

What used to be good enough no longer passes the test.

Providers like Mastercard now require higher standards of compliance to keep merchants and customers protected.

Last, but definitely not least, outdated platforms limit scalability.

When every integration with a payment processor requires custom engineering, adding local payment methods, supporting multiple currencies, or entering new markets becomes slow and costly.

Meanwhile, competitors with cloud-native, orchestrated systems move faster, capture trust, and expand market share.

The bottom line: failing to modernize doesn’t just pause growth, it accelerates risk. That’s why you need a proactive, strategic approach to scaling payments before small cracks turn into costly crises.

Orchestration as the North Star

Scaling payment infrastructure isn’t only about processing more transactions; it’s about creating a system that adapts as your business grows. That’s where a modern payment platform with orchestration comes in.

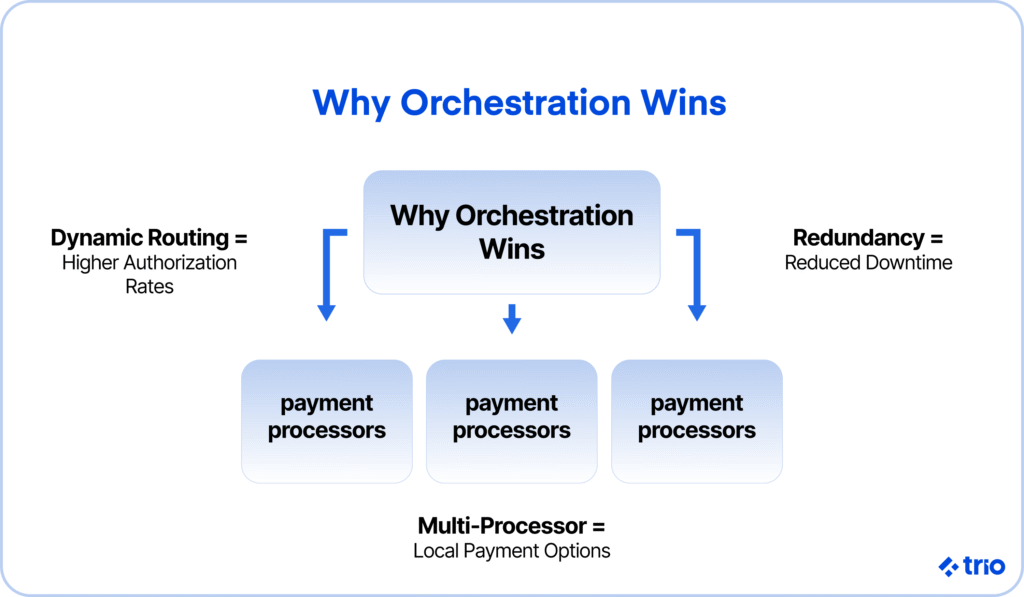

Payment orchestration platforms connect multiple processors, acquirers, and payment methods through a single layer.

Instead of depending on one PSP, orchestration enables dynamic routing, improves authorization rates, and adds redundancy when one processor fails.

In our experience, most enterprises already juggle multiple providers, often four processors and three acquirers, to avoid bottlenecks. Orchestration turns that complexity into an advantage, letting businesses cut costs, reduce downtime, and localize payments without reengineering their entire infrastructure.

The choice between building an orchestration layer in-house or partnering with a specialist comes down to priorities.

Building internally offers complete control, but it demands significant engineering and compliance resources. If you decide to take this path, we can connect you with the relevant talent, giving you peace of mind knowing you have experienced developers on your team.

Partnering accelerates speed-to-market, brings proven expertise, and reduces operational overhead. Both paths point to the same outcome: orchestration as the foundation for global scale.

Building Modern Payment Infrastructure

Legacy payment systems weren’t built for global scale, multi-currency transactions, or the sophisticated fraud landscape that modern businesses face.

By contrast, contemporary platforms are designed for scale, capable of handling massive transaction volumes without downtime, and for flexibility, with the ability to integrate seamlessly with a wide range of processors and payment methods.

High availability isn’t negotiable anymore.

Modern systems use active-active, multi-region architectures, automated failover, and rigorous disaster recovery testing to achieve four-nines uptime (≥99.99%).

Techniques like retries, circuit breakers, and idempotency keys ensure that even when part of the network stumbles, the transaction still goes through.

Forward-looking teams go further, implementing tokenization to minimize PCI scope and adopting 3DS v2.2 with SCA exemptions to reduce fraud risk without creating customer friction.

Upgrading to this kind of infrastructure doesn’t just make systems more efficient; it protects business continuity in a high-stakes environment where every failed transaction matters.

To make modernization actionable, teams need a clear checklist to keep progress on track.

- Infrastructure-as-code for repeatable, auditable deployments

- Observability with clear SLOs (latency, uptime, error rate)

- Blue/green or canary releases to minimize deployment risk

- Global redundancy (multiple acquirers, processors, and data centers)

- Real-time fraud monitoring with ML augmentation

The point of this checklist isn’t to modernize once and move on. The goal is to build a payment system that stays modern as technologies, threats, and expectations evolve.

Phased Payment System Modernization Roadmap

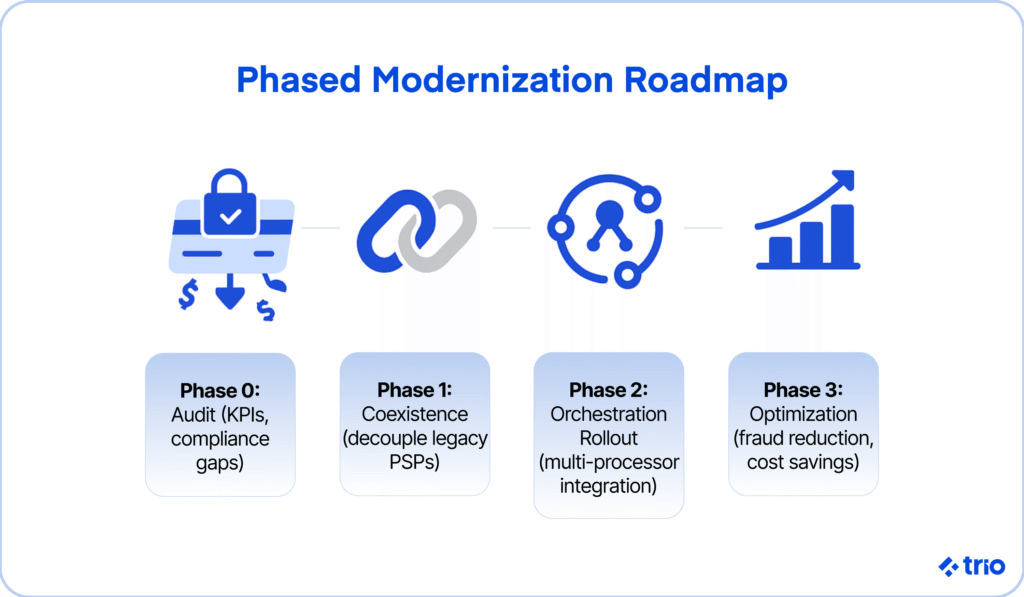

The most successful companies take a phased approach, modernizing step by step while managing risk and tracking outcomes.

Phase 0: Assess. Everything starts with visibility. Audit existing systems for uptime, latency, and authorization rates. Document compliance gaps and fraud exposure. Establish baseline KPIs to measure whether the new infrastructure is delivering results.

Phase 1: Coexistence. Begin decoupling from legacy PSPs with an abstraction layer or gateway. Tokenize customer data to prevent it from being locked to a single provider. Run sandbox parity tests to ensure that new systems can match existing performance before going live.

Phase 2: Orchestration Rollout. Once the foundation is in place, expand by integrating multiple processors and acquirers. This is where orchestration starts to pay off: dynamic routing, A/B testing across providers, and smart retries that recover failed transactions all drive higher success rates.

Phase 3: Optimization. With orchestration live, optimization becomes continuous. ML-driven risk scoring reduces false declines. 3DS v2.2 exemptions reduce friction in compliant regions. Routing logic can be tuned to save costs and boost approval rates.

At every stage, the guiding principle is the same: tie technical decisions to measurable business outcomes. That might mean higher authorization lift, reduced latency, fewer fraud losses, or more substantial uptime percentages.

Global Payment Solutions Expansion Mechanics: and Key Challenges

Scaling payments is about volume and reaching new markets. Global expansion brings its own set of challenges, and the proper infrastructure can mean the difference between seamless growth and frustration.

Local Payment Methods

In many markets, cards aren’t the default. In many, they aren’t the only option.

Customers expect to pay with local options, whether that’s iDEAL in the Netherlands, Pix in Brazil, or mobile wallets like Apple Pay in North America and Europe.

Meeting those expectations directly impacts conversion rates and builds long-term trust.

Local Acquiring vs. Cross-Border

Relying on a single cross-border acquirer often means higher costs and lower approval rates.

Local acquiring, on the other hand, reduces friction, satisfies domestic compliance requirements, and boosts acceptance.

Payment orchestration makes this easier, allowing businesses to plug in local acquirers without re-architecting their entire stack.

Multi-Currency and FX Handling

For global businesses, multi-currency support isn’t optional. Customers want to see prices in their own currency, and doing so improves conversion rates. Behind the scenes, treasury teams need the right tools to manage FX costs and reduce exposure. Modern infrastructure makes both possible.

Reconciliation and Settlement

As businesses add payment partners, complexity multiplies along with their risks and vulnerabilities.

Automated reconciliation across acquirers, currencies, and methods gives finance teams real-time visibility into cash flow. That visibility is crucial for making fast, confident decisions in a global market.

Ultimately, the ability to adapt payment flows to each market is what turns scaling into a business advantage.

Case Callouts: Who’s Doing It Well

Abstract principles are helpful, but real-world examples show what scaling payments looks like in practice.

Starbucks launched its own mobile app and digital wallet, which securely tokenizes customer credentials. The result has been faster checkouts, shorter lines in busy stores, and higher repeat purchase rates, with the app accounting for over 31% of store transactions in 2024 and boosting loyalty program engagement.

Uber operates across dozens of countries, where cards alone don’t suffice.

By integrating local wallets (like Alipay in China and Paytm in India in 2016) and bank transfer options through its payments platform, Uber increased acceptance rates and smoothed global expansion.

Netflix, with its subscription model, faced involuntary churn from failed recurring payments. By adopting a multi-acquirer strategy, implementing smart retries, and leveraging network tokens, Netflix reduced declines and stabilized revenue streams.

Different industries, same lesson: scaling payments means adapting infrastructure to local demand, reducing risk, and optimizing performance. The businesses and financial institutions that modernize early see the benefits first and set the pace for everyone else.

Best Practices for Scaling with Confidence

Scaling payments isn’t just about building bigger systems; it’s about creating smarter ones. Strategy matters, but it’s the everyday practices that determine whether payments stay reliable and secure under pressure.

Onboarding and monitoring are a good place to start.

Merchants and partners need to be integrated quickly, but with precision. When transactions are tracked in real time, potential bottlenecks are caught before they disrupt customers. Defining clear SLAs for onboarding and performance across regions keeps teams accountable and aligned.

Also consider that security has to be proactive, not reactive.

Traditional audits and updates are essential, but modern scaling requires more: automation of penetration testing, real-time fraud thresholds, and regulatory compliance checks built directly into release cycles. Treating security as an ongoing process, not a one-off milestone, reduces exposure and builds trust with customers.

Partnerships also play a key role. No business should rely on a single PSP or acquirer. Multi-acquirer strategies spread risk and ensure resilience. If one provider falters, payments continue without disruption.

Finally, resilience has to be proven.

Disaster recovery plans on paper aren’t enough; they need to be validated through regular failover drills in production-like environments. We can help you set this up.

Alongside this, you should monitor KPIs like authorization rates, latency at the 95th and 99th percentiles, and chargeback ratios.

Staying close to these metrics means issues get caught early, before they escalate into real problems and affect your operational efficiency.

Future of Payments and Fintech

The payments landscape is evolving fast, and the trends shaping it aren’t abstract; they’re already here.

Digital wallets have shifted from novelty to necessity, becoming the default in many markets.

Real-time payments are turning instant transfers into the new payment standard, with regulators pushing for faster settlement. These shifts demand infrastructure designed for immediacy, not overnight batch processing. This is a reflection of how critical payments have become in powering the digital economy.

Artificial intelligence and machine learning are also moving from pilots into production.

Beyond fraud detection, AI is driving personalization by predicting which payment method a customer is most likely to use or when a retry will succeed.

Blockchain and distributed ledgers hold promise for faster, more transparent cross-border payments, even if adoption remains uneven. And cloud computing has already proven its worth, providing the scalability needed to meet rising transaction volumes without the drag of physical infrastructure.

What unites all these shifts is the need for adaptability. The winners will be those with infrastructure that is flexible enough to support new methods, integrate emerging technologies, and adapt to regulatory changes as they arise.

Toolkit and Metrics

Scaling payments without measurement is like flying blind. To determine whether infrastructure is delivering, businesses require the right metrics, tracked consistently and shared across teams.

Authorization rates are one of the most important signals. Even a one-point increase can translate into millions in recovered revenue for large enterprises. Tracking approvals by acquirer, geography, and payment method shows whether orchestration and routing strategies are doing their job.

Latency and uptime tell the story of reliability.

Uptime percentages matter, but so does speed. Measuring latency at the 95th and 99th percentiles, as we’ve already mentioned, reveals whether the system is fast for all customers, not just the average case. Mature systems should aim for 99.99% availability, validated with regular failover drills to confirm recovery objectives are achievable.

Fraud and chargebacks need to be closely monitored as the scale increases. Fraud loss percentages, false declines, and chargeback ratios all impact both compliance and customer experience.

Effective systems balance fraud prevention with minimal friction, keeping customers safe without turning away legitimate transactions.

Cost per successful transaction is another critical metric. Raw processing costs mean little without context.

Dividing spend by the number of approved transactions shows whether scaling is driving profitability or simply inflating overhead. This measure also highlights where operational costs can be reduced through more intelligent routing, better fraud prevention, or improved authorization strategies.

Finally, operational dashboards tie it all together. Metrics should be visible to engineering, finance, and risk teams alike. When every stakeholder has real-time visibility into payment performance through robust API integrations, issues are resolved faster, and decisions are grounded in evidence instead of assumptions.

Conclusion

Scaling payment infrastructure is no longer optional; it’s the foundation for growth, trust, and global reach.

Legacy systems may have carried your business and many others this far, but they can’t deliver the speed, security, or adaptability that customers demand today.

The way forward rests on three pillars: orchestration to reduce dependency on any single PSP, cloud-native infrastructure to deliver resilience at scale, and a phased modernization roadmap that balances innovation with risk management.

These aren’t abstract theories; they’re proven patterns used by the companies leading the way in global digital payments.

At Trio, we’ve seen firsthand how organizations accelerate once payment solutions stop being a bottleneck. By helping businesses design, modernize, and scale their infrastructure, we turn payments from a back-office necessity into a competitive advantage.

If you’re ready to modernize your payment technologies and scale with confidence, we are here to help. Reach out to connect with the right people as soon as possible and start building the infrastructure that will support your growth!